AFRICAN DEVELOPMENT

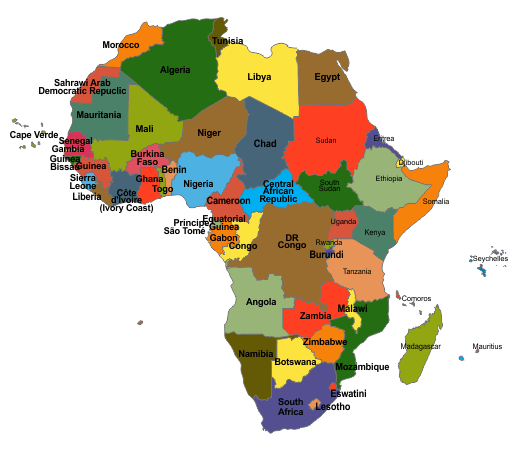

The African continent has experienced significant transformations over the past few centuries. While the most notable changes pertain to the economic, cultural, and political landscapes, certain regions have undergone drastic alterations and influences.

The matter of African education development necessitates further consideration due to the impact of Western nations and the repercussions stemming from the colonial era. Higher education institutions are also a cause for concern due to inadequate funding and unfavorable conditions for students to excel.

Additionally, digital learning can facilitate creative education in business, but it requires substantial financial resources. This is due to the need for advanced technological tools that are expensive and require specific conditions.

Furthermore, education is being shaped by the development agenda, which involves transitioning to a digital environment. This entails the use of computers, tablets, and smartphones to carry out educational activities.

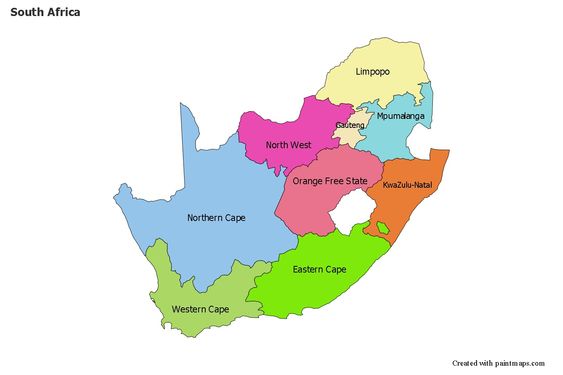

South Africa

Cyril Ramaphosa ( South Africa /President)

South Africa has taken considerable strides to improve the well-being of its citizens since its transition to democracy in the mid-1990s, but progress has stagnated in the last decade. The percentage of the population living below the upper-middle-income country poverty line fell from 68% to 56% between 2005 and 2010 but has since trended slightly upwards, to 57% in 2015, and is projected to have reached 60% in 2020.

Structural challenges and weak growth have undermined progress in reducing poverty, heightened by the COVID-19 pandemic. The achievement of progress in household welfare is severely constrained by rising unemployment, which reached an unprecedented 35.3% in the fourth quarter of 2021. By the second quarter of 2023, the unemployment rate had declined marginally to 32.6%, still above the already high pre-pandemic levels. The unemployment rate is highest among youths aged between 15 and 24, at around 61%.

Other structural challenges have also increased, transport and logistics, which have deteriorated due to weak management of the state-owned enterprise Transnet, theft, and sabotage, constraining South Africa’s export capacity.

South Africa remains a dual economy with one of the highest and most persistent inequality rates in the world, with a consumption expenditure Gini coefficient of 0.67 in 2018. High inequality is perpetuated by a legacy of exclusion and the nature of economic growth, which is not pro-poor and does not generate sufficient jobs. Inequality in wealth is even higher, and intergenerational mobility is low, meaning inequalities are passed down from generation to generation with little change over time.

Ethiopia

Sahle-Work Zewde ( Ethiopia /President)

With about 123 million people (2022), Ethiopia is the second most populous nation in Africa after Nigeria, and one of the fastest-growing economies in the region, with an estimated 6.4% growth in FY2021/22. However, it also remains one of the poorest, with a per capita gross national income of $1,020. Ethiopia aims to reach lower-middle-income status by 2025.

Ethiopia’s strong growth rate builds on a longer-term record of growth over the past 15 years where the country’s economy grew at an average of nearly 10% per year, one of the highest rates in the world. Among other factors, growth was led by capital accumulation, in particular through public infrastructure investments. Ethiopia’s real gross domestic product (GDP) growth slowed down from FY2019/20 to FY2021/22 due to multiple shocks including COVID-19, with growth in industry and services easing to single digits. However, agriculture, where over 70% of the population is employed, was not significantly affected by the COVID-19 pandemic, and its contribution to growth slightly improved compared to previous years.

The consistently high economic growth over the last decade resulted in positive trends in poverty reduction in both urban and rural areas. The share of the population living below the national poverty line decreased from 30% in 2011 to 24% in 2016 and human development indicators improved as well. However, gains are modest when compared to other countries that saw fast growth, and inequality has increased in recent years. Furthermore, conflicts in various parts of Ethiopia risk undermining the economic and social development progress the country has achieved.

The government has launched a 10-Year Development Plan, based on its 2019 Home-Grown Economic Reform Agenda, which runs from 2020/21 to 2029/30. The plan aims to sustain the high growth achieved under the Growth and Transformation Plans of the previous decade while facilitating the shift towards a more private-sector-driven economy. It also aims to foster efficiency and introduce competition in key growth-enabling sectors (energy, logistics, and telecom), improve the business climate, and address macroeconomic imbalances.

Development Challenges

Ethiopia seeks to chart a development path that is sustainable and inclusive to accelerate poverty reduction and boost shared prosperity. Significant progress in job creation, as well as improved governance, will be needed to ensure that growth is equitable across society. Achieving these objectives will require addressing key challenges including the following:

- Addressing macroeconomic distortions that constrain private sector development, structural transformation, and generation of jobs.

Reducing the incidence of conflict that has been having a substantial impact on lives, livelihoods, and infrastructure. The cessation of hostilities in the North in November 2022 is an important step in this direction. - Addressing food insecurity, which is growing due to adverse weather events, locust invasion, conflict, and global conditions leading to high inflation of food prices. Frequent severe weather events alongside long-term impacts of climate change undermine agriculture and pastoral livelihoods as well as food security. The 2022 drought is the worst in forty years, severely affecting millions in the southern and eastern parts of the country. Overall, more than 20 million persons are facing severe food insecurity in 2023.

- Improving human capital. Ethiopia’s Human Capital Index is at a low 0.38 (2020) which means that a child born in Ethiopia today will be 38% as productive when s/he grows up as s/he could be if s/he enjoyed complete education and full health. This is lower than the average for the Sub-Saharan Africa region but slightly higher than the average for low-income countries. Learning poverty stands at 90% and 37% of children under 5 years of age are stunted.

- Generating good jobs. The country’s growing workforce (with roughly 2 million persons reaching working age per year) puts pressure on the absorption capacity of the labor market and necessitates improving current jobs while creating sufficient new jobs.

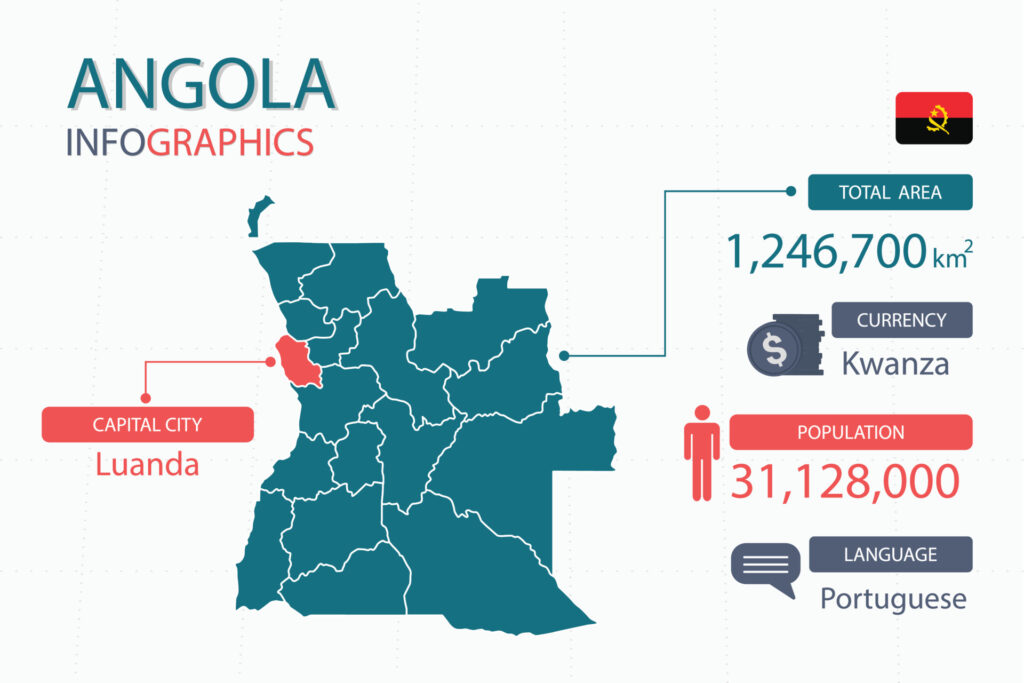

Angola

João Lourenço ( Angola /President)

A vast country with a long coastline and central plateau, Angola thrusts inland across Southern Africa to border Namibia, Botswana, Zambia, and the Democratic Republic of the Congo. Its principal cities, including its capital, Luanda, look west over the South Atlantic to Brazil, another Portuguese-speaking nation (like itself). It has a population of more than 33.08 million (2022).

Economic Overview

Angola’s economic fortunes have been tied to global oil demand, which brought volatile growth and left the country with high levels of poverty and inequality. Reforms over the past five years have improved macroeconomic management and public sector governance. Macroeconomic stability has been enhanced through a more flexible exchange rate regime, central bank autonomy, sound monetary policy, and fiscal consolidation. Laws have been introduced to allow greater private sector participation in the economy, increasing the stability of the financial sector.

Growth accelerated in 2022 to 3% (from 1.2% in 2021) thanks to expansion in non-oil sectors and a small rebound in oil production. Higher oil prices allowed for fiscal expansion, especially in public investments, and appreciation of the domestic currency, underpinning strengthening domestic demand and generating a 7% growth in private consumption.

The oil sector contributed to this recovery with a growth of 0.5%, the first expansion since 2015. Non-oil output accelerated with agriculture and fisheries growing almost 4% and the services sector recovering to pre-COVID-19 levels. Construction activity expanded 5.5%, benefiting from higher government investment in the context of improved financial conditions and an election year.

In the first quarter of 2023, the economy expanded 0.3% year-on-year as growth in services (4.1%) was offset by a decline in oil production (-8.0 %). With higher oil prices, the currency appreciated 26.2% in 2022, though appreciation pressures receded in the second half of the year once oil prices began to fall. Between mid-May and end-June 2023, the kwanza depreciated around 40% against the US dollar due to lower government supply of foreign currency, resulting from lower oil revenues and larger external debt servicing as debt relief deals expired.

The current account surplus decreased to 0.4% of GDP in the second quarter of 2023, driven by lower oil revenues. International reserves remain stable at around $13 billion or about seven months of imports. Inflation continued falling rapidly from a peak of 27.7% in January 2022 to 10.6% in April 2023. However, the partial removal of gasoline subsidies and the weakening of the kwanza have reversed the inflation’s declining trend. The reform raised gasoline prices from 160 to 300 kwanzas per liter in June and mitigation measures were insufficient to shield poorer consumers.

As inflationary pressures resurge, the Central Bank has decided to keep the reference rate at 17%. Growth for 2023 is estimated at 1.3%, as both the oil and the non-oil sectors are expected to underperform. Despite the recent recovery in oil production, the average in 2023 will very likely stand close to the 2022 level. Non-oil sectors will be affected by cuts in public investments and a recent sharp currency depreciation, which is harming private consumption and production in sectors that rely on imported inputs. Slowing growth and rising food prices are expected to result in negative per capita private consumption growth and increased poverty at $2.15 per day (2017 PPP) from 32.4% to 32.8% in 2023, with a total of 11.8 million Angolans living in poverty.

While much remains to be done to achieve this transformation, reforms over the past years have improved macroeconomic management and public sector governance. Transforming the state-led and oil-funded economic model into a sustainable, inclusive, private-sector-led growth model requires high-level political commitment, strong coordination, and solid institutions.

Development and social challenges

High poverty is linked to a lack of good quality jobs: 80% of jobs are informal and half are in the primary sector (often subsistence work). Urban and youth unemployment remain high, exceeding 38% and 50%, respectively. Economic diversification remains elusive while oil production is declining and global decarbonization looms in the medium-term. Angola needs to urgently invest in removing barriers to private sector investment to achieve economic diversification to support growth, job creation, and poverty reduction. With abundant agricultural and arable land and favorable climatic conditions, agriculture is the sector with the highest potential to drive this diversification. Nonetheless, Angola will need to build climate resilience as its exposure to extreme climatic events is expected to increase water scarcity, increase temperatures, and extend dry seasons, hurting agricultural productivity.

Given the jobs challenge, high poverty, and a rapidly growing population, investing in human capital and poverty reduction is a top priority. The inadequate provision of health and education reduce the potential productivity of a child born in Angola to 36% of what it could be. Recent investments in education and health have been complemented with the roll-out of a social registry and the Kwenda cash transfer program in 2020, with nearly 750,000 rural households receiving payments as of August 2023. A broader social safety net with adaptable income support could substantially reduce extreme poverty, mitigate the impact of shocks on households, and support investments in human capital. Investments in human capital will require sustainably increasing spending and improving management and accountability to ensure results.

Political Context

Angola’s fourth, post-war elections were held on August 24, 2022, and the ruling MPLA (Popular Movement for the Liberation of Angola) party won with 51% of the vote. UNITA (Union for the Total Independence of Angola), the main opposition party, secured 44% of the votes, its best results ever. The results confirmed a second and final term for President João Lourenço.

Overall, the opposition won 96 seats, up from 70 in the 2017 elections. The government comprises 23 ministers and 3 ministers of state.

Internationally, Angola is continuing to be assertive and demonstrating a steadfast commitment to peace and stability in Africa, particularly in the Democratic Republic of Congo where it has led regional efforts to end the instability which threatens the entire Great Lake Region.

Kenya

William Ruto ( Kenya /President)

The country has made significant political and economic reforms that have contributed to sustained economic growth, social development, and political stability gains over the past decade. However, its key development challenges still include poverty, inequality, youth unemployment, transparency and accountability, climate change, continued weak private sector investment, and the vulnerability of the economy to internal and external shocks.

Kenya’s economy achieved broad-based growth averaging 4.8% per year between 2015-2019, significantly reducing poverty (from 36.5% in 2005 to 27.2% in 2019 ($2.15/day poverty line).

In 2020, the COVID-19 pandemic shock hit the economy hard, disrupting international trade and transport, tourism, and urban services activity. Fortunately, the agricultural sector, a cornerstone of the economy, remained resilient, helping to limit the contraction in GDP to only 0.3%. In 2021, the economy staged a strong recovery, with the economy growing at 7.5% although some sectors, such as tourism, remained under pressure. GDP growth however declined to 4.8% in 2022 and is projected to grow at 5.0% in 2023. The poverty rate has resumed its trend decline after rising earlier in the pandemic. Although the economic outlook is broadly positive, it is subject to elevated uncertainty, including through Kenya’s exposure (as a net fuel, wheat, and fertilizer importer) to the global price impacts of the war in Ukraine.

World Bank support to Kenya includes budget support to help close the fiscal financing gap while supporting reforms that help advance the government’s inclusive growth agenda.

In addition to aligning the country’s long-term development agenda to Kenya’s Vision 2030−which aims to transform Kenya into a competitive and prosperous country with a high quality of life−the government’s bottom-up economic model prioritizes agriculture, healthcare, affordable housing, micro and small enterprises, and the digital and creative economy.

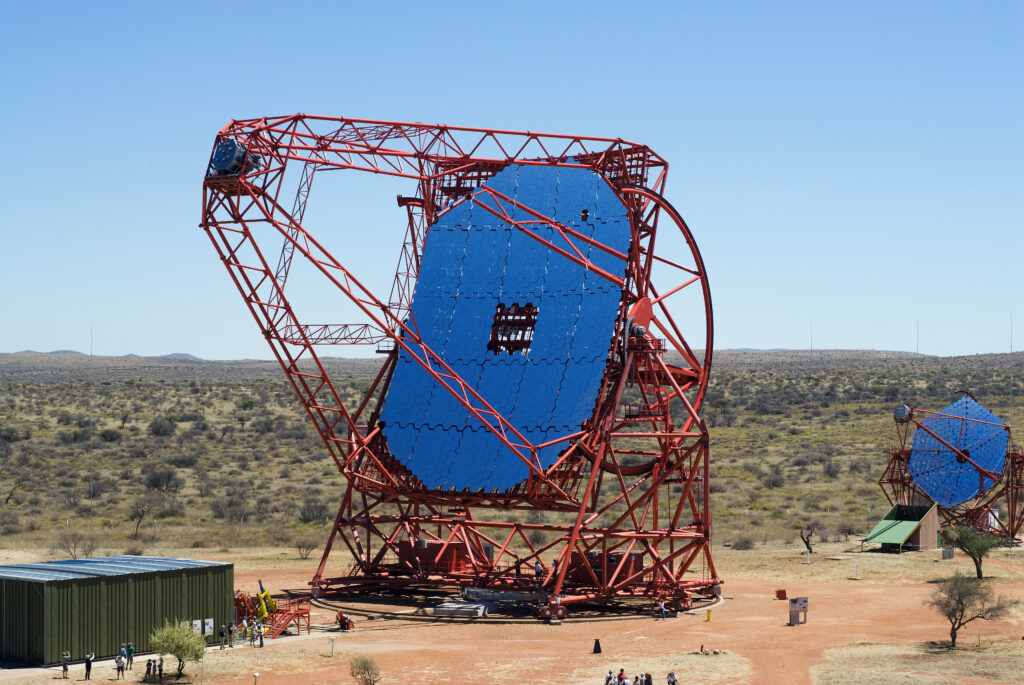

namibia

Hage Geingob ( Namibia /President)

Namibia is a geographically large country with a small population of about 2.53 million (2021) and a 1,500 km-long coastline on the South Atlantic. The driest country in Sub-Saharan Africa, it is rich in mineral resources, including diamonds and uranium, sharing borders with Angola, Botswana, South Africa, and Zambia.

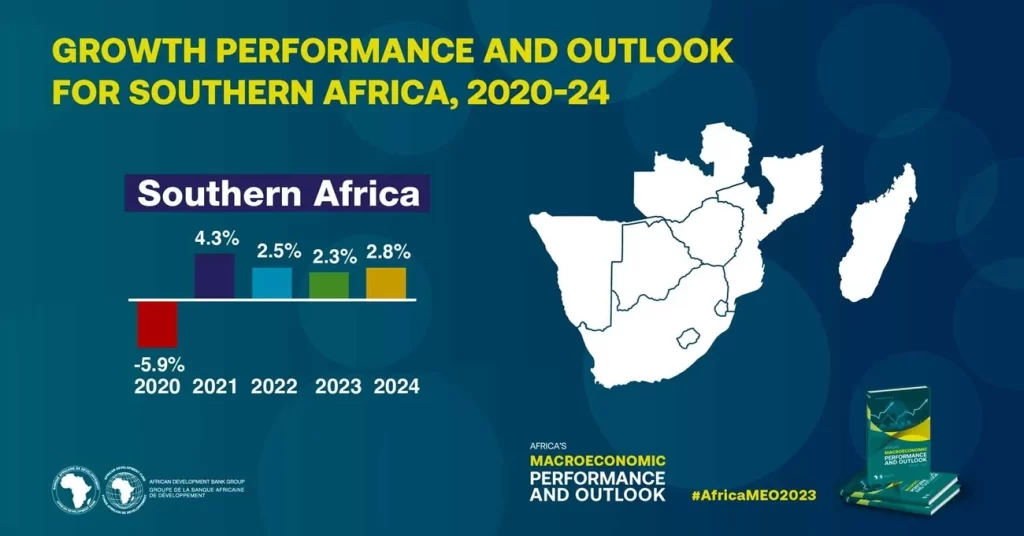

Resource wealth, political stability (or strong governance and institutions), and sound macroeconomic management have helped poverty reduction and allowed Namibia to become an upper-middle-income country. However, socioeconomic inequalities—the legacy of apartheid systems of government in the past—remain extremely high and were worsened by the COVID-19 pandemic. Structural constraints to growth have also hampered productivity gains and job creation. The debt-to-GDP ratio remains elevated, at above 70% of GDP, reflecting low growth, expenditure pressures, and rising debt servicing costs.

Economic Outlook

Economic activity in Namibia is projected to grow at 2.8% in 2023, down from 4.6% in 2022, due to relatively high inflation, monetary tightening, and lower growth in South Africa and Europe. On top of both droughts and flooding, agricultural production has been hampered by higher fertilizer prices due to the war in Ukraine.

Despite the economic recovery in 2022, the socioeconomic situation did not improve significantly.

Employment is estimated to remain below pre-pandemic levels as labor-intensive manufacturing subsectors have added jobs relatively slowly. Spurred by higher fuel prices, inflation increased to a five-year high of 6.1% in 2022, disproportionately affecting the most vulnerable. Poverty rates are estimated to remain above pre-pandemic levels.

Global and regional developments are important drivers of Namibia’s economic performance, as well as fiscal and external positions, as the country is highly reliant on commodity exports and Southern African Customs Union (SACU) transfers.

Development Challenges

Since its independence in 1990, Namibia had made progress in reducing poverty, halving the proportion of Namibians living below the national poverty line to 28.7% in 2009-10 and to 17.4% by 2015-16.

Despite this, deep underlying challenges persist, undermining the prospects for further advancement. A pre-1990 history of the systematic exclusion of the black majority from full participation in economic activities continues to shape society and the economy, constraining the country’s economic and social progress to this day. Economic advantage remains in the hands of a relatively small segment of the population, and significant inequality continues. This lack of inclusiveness and society’s vast disparities have led to a dual economy—a highly developed modern sector, co-existing with an informal subsistence-oriented one—and are manifested in three main socio-economic challenges that define the economy:

- Namibia ranks as one of the world’s most unequal countries. Its Gini coefficient of 59.1 in 2015 was second only to South Africa. Geographical disparities in both economic opportunities and access to services are large and widening. High levels of inequality result in starkly different poverty rates across different groups, including by age and gender.

- Relatively high poverty, lagging human capital, and poor access to basic services are interrelated problems. Namibia’s poverty rapidly declined from 1993/94 to 2015/16, but it remains high for the country’s level of development. Despite recent progress, Namibia ranked 117th among 157 countries on the Human Capital Index.

- The duality of the labor market, combined with slow job creation and low primary-sector productivity, results in very high unemployment.

Due to consistently negative per capita GDP growth since 2016, and the negative impact of COVID-19 on livelihoods, poverty rates are projected to have increased. Typically, female-headed households, less educated, larger families, children and the elderly, and laborers in subsistence farming, are particularly prone to poverty.

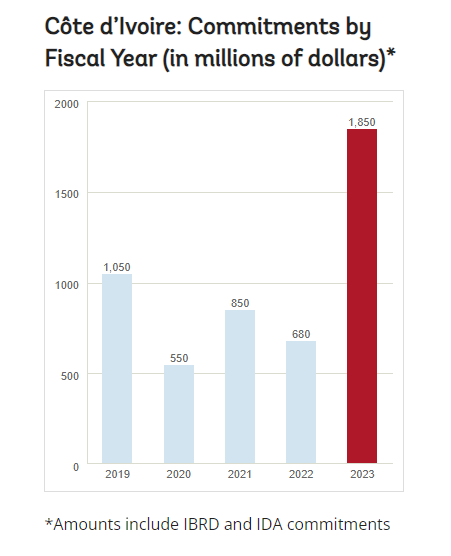

Ivory Coast

Alassane Ouattara ( Côte d'Ivoire/President)

Côte d’Ivoire, the world’s leading cocoa and cashew producer, is experiencing one of the fastest sustained economic growth rates in Sub-Saharan Africa in over a decade. With real GDP growth averaging 8.2% between 2012-and 2019, Côte d’Ivoire successfully contained the COVID-19 pandemic and maintained a 2% rate in 2020. In 2021, the country returned to its high-growth trajectory and continues to play a central role as a regional economic hub and host country for many nationals from the Economic Community of West African States (ECOWAS) and elsewhere.

Economic Overview

In 2022, Ivorian economic activity remained robust, despite facing challenges arising from Russia’s invasion of Ukraine, global monetary tightening, and growing political instability in the West African Economic and Monetary Union (WAEMU). Despite rising import prices, rising global and domestic interest rates, and declining external demand, economic growth is forecast to fall from 7% in 2021 to 6.7% in 2022.

Growth was largely driven by sustained public investment and strong domestic consumption. Industrial and service sectors and the government’s fiscal measures to control price rises also contributed to this economic performance in the first half of the year.

Inflation averaged 5.2% in 2022, marking its highest level in a decade, driven by rising food, transport and energy prices. Nevertheless, the short- and medium-term economic outlook remains positive, albeit slightly below pre-COVID-19 levels. This optimism is underpinned by a strong commitment to macroeconomic stability and ongoing structural reforms in line with the National Development Plan (NDP 2021-2025).

Real GDP growth is expected to average 6.5% in 2024-25. Continued investment in network infrastructure, particularly in the digital and transport sectors, and the exploitation of recent oil discoveries, combined with prudent macroeconomic policies, should boost business confidence and boost productivity. Projects to develop value chains have the potential to improve agricultural productivity and boost manufacturing, underpinning long-term growth prospects.

Political Context

In September 2023, Côte d’Ivoire held municipal and regional elections that were largely won by the RHDP [Rassemblement des Houphoutistes pour la Démocratie et la Paix], the party in power since 2011. This double ballot, a test for the country’s main political parties ahead of the 2025 presidential election, was unanimously hailed as inclusive, open, and peaceful by all national and international observers. Since the resolution of tensions linked to the 2020 presidential election, at the end of which President Ouattara was re-elected for a third consecutive term, Côte d’Ivoire has enjoyed notable political and social stability. However, the country is facing a humanitarian challenge in its northern part, bordering Burkina Faso, due to the influx of refugees mainly fleeing jihadist violence in the neighboring country.

The construction of a bridge, built by Chinese engineers, that connects crucial neighborhoods in the economic hub of Cote d’Ivoire is approaching its final stages.

The ongoing construction of the 4th Bridge of Abidjan in Cote d’Ivoire, which is being built by China State Construction Engineering Corporation (CSCEC), is expected to revolutionize transportation between Abidjan’s major communities.

This bridge project aims to provide an alternative route to the heavily congested Northern Highway, offering a smoother commuting experience for the residents.

Qiao Weidong, the project’s leader at CSCEC’s Cote d’Ivoire branch, stated that the bridge, which is currently over 80 percent complete, will connect Yopougon, the largest commune in the economic capital, to Plateau via Attecoube and Adjame.

Once operational, it is projected to accommodate a significant number of vehicles daily, effectively alleviating the traffic congestion in this bustling West African metropolis.

Tan Dengfeng, responsible for market relations at CSCEC, highlighted the challenges posed by the city’s geographical layout, with lagoons dividing it into multiple zones that necessitate bridge connections. He further explained that the existing three bridges often experience severe congestion during peak hours.

Resident Luc Koula emphasized the significance of the 4th Bridge of Abidjan, particularly for those commuting from Yopougon to Plateau for work.

Plateau serves as the city’s business district and government administration hub, and many individuals currently spend two to three hours traveling via the Northern Highway.

While ferries are available for crossing the lagoons, car travel is a more practical option for those residing further inland.

The 4th Bridge of Abidjan project, spanning approximately 7 km, commenced in August 2018 as a crucial component of the Abidjan Urban Transport Project.

It comprises seven distinct sections and is poised to enhance connectivity and ease the daily commute for thousands of residents in Abidjan.

Education

The Education Service Delivery Enhancement Project (PAPSE), also known as the “My Child Learns Better in School” project:

- Enabled 63,398 children in CP1, CP2, and CE1 classes, including 31,887 girls, to improve their reading, writing, and math skills;

- Improved early childhood development by supporting 13,996 children, including 6,974 girls;

- Encouraged the enrolment of 8,595 female students through the distribution of complementary school kits;

- Strengthened the pedagogical capacities of 769 reading-writing teachers and 1,033 mathematics teachers.

Ivory Coast: Launch of the construction of the University of San Pedro

This occasion marks the initial significant stride towards the establishment of the forthcoming edifice. Under the University Decentralization Program (PDU), the University of San Pedro’s development is being undertaken through a collaborative effort between the public and private sectors, specifically with Envol Partenariats CI.

University of San Pedro Ivory Coast

Cameroon

Paul Biya ( Cameroon /President)

Cameroon is a lower-middle-income country with a population of over 27.2 million (2021). Located along the Atlantic Ocean, it shares its borders with the Central African Republic, Chad, Equatorial Guinea, Gabon, and Nigeria. Two of its border regions with Nigeria (northwest and southwest) are Anglophone, while the rest of the country is Francophone. Cameroon is endowed with rich natural resources, including oil and gas, mineral ores, and high-value species of timber, and agricultural products, such as coffee, cotton, cocoa, maize, and cassava.

Political Context

The first regional elections were held in December 2020. The ruling party, the Cameroon People’s Democratic Movement (CPDM), won nine of the ten regions. These elections mark the start of the decentralization process provided for in the 1996 Constitution. The new regional councilors will work with the Ministry of Decentralization and Local Development to pave the way for the gradual transfer of power and the necessary funds to the regions.

Having enjoyed several decades of stability, Cameroon has in recent years been grappling with attacks by Boko Haram in the Far North and a secessionist insurgency in the Anglophone regions. Since September 2017, this situation has displaced more than one million internally and around 470.000 refugees have sought shelter in Cameroon. Following the resurgence of the crisis in the Central African Republic since January 2021, over 6,000 Central Africans refugees fled to Cameroon’s East region which was already hosting over 60 % of Central African refugees. According to UNHCR September 2023 figures, Cameroon is hosting over 460.000 refugees, primarily from the Central African Republic (73%) and Nigeria (26%).

Social Context

Because its poverty reduction rate is lagging behind its population growth rate, the overall number of poor in Cameroon increased by 12 % to 8.1 million between 2007 and 2014, and poverty is concentrated in the country’s northern regions, where 56 % of the poor live.

Development Challenges

Ranked 142 out of 180 countries in the 2022 Transparency International corruption perceptions index, Cameroon suffers from weak governance, hindering its development and ability to attract investors.

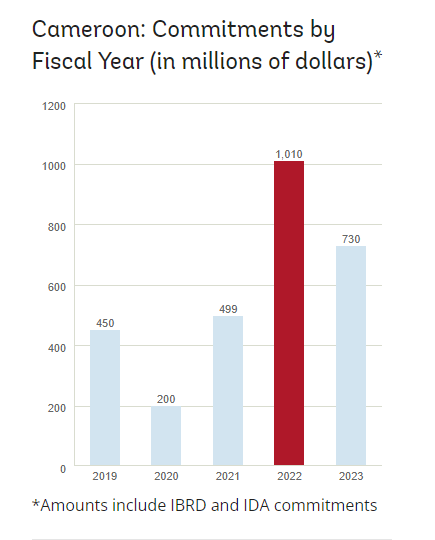

Economic Overview

Since November 2021, Cameroon is experiencing high inflation, driven mainly by shortage and increase of the price of staple goods (bread, wheat and related products, vegetable oil, and meat), which can be explained by the disruption of the global value chain due to Covid-19 pandemic and Ukraine’s invasion by Russia.

This has impeded Cameroon’s economic recovery, heightening inflation pressures and domestic structural vulnerabilities.

The economic outlook is expected to remain moderately favorable over the medium term, but risks are tilted to the downside.

Cameroon’s real GDP growth is projected to reach 4.2% , on average, over 2023-25, supported by sustained activity in the secondary and tertiary sectors.

Boosting Electricity Production

Two projects being financed by the IBRD and IDA aim to boost access to electricity: the Rural Electricity Access Project that is being implemented in more than 400 localities and is benefiting one million people, and the Upstream Nachtigal Hydroelectric Project, which will support construction of a 420 MW dam. The Nachtigal power plant will be connected to the Southern Interconnected Grid, which accounts for approximately 94 % of Cameroon’s electricity consumption.

Enhancing Regional Trade and Integration

The Lake Chad Region Recovery and Development Project (PROLAC), which is being financed by IDA in the amount of $60 million, seeks to strengthen regional cooperation with a view to addressing the shared challenges in the subregion that foment terrorism and insecurity. It aims to improve community access to markets and socioeconomic services and includes initiatives that promote civic engagement and social cohesion.

Improving Agricultural Competitiveness

World Bank engagement in the agricultural sector comprises two IDA-financed operations. The Acceleration of the Digital Transformation of Cameroon Project supports the establishment of a more enabling environment for the development of a digital economy and the reduction of digital divides in rural areas, while seeking to facilitate the implementation of solutions that will spur agricultural innovation.

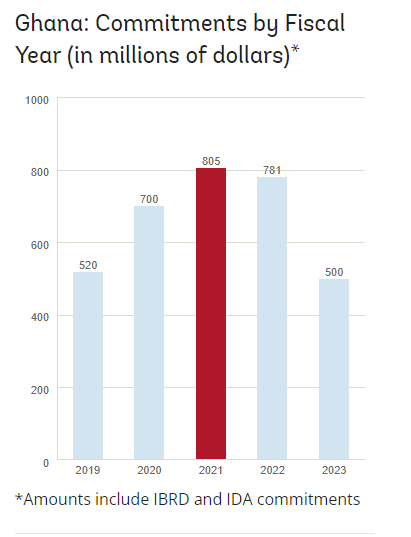

Ghana

Nana Akufo-Addo ( Ghana /President)

Ghana sits on the Atlantic Ocean and borders Togo, Cote d’Ivoire, and Burkina Faso. Its population is about 29.6 million (2018). In the past two decades, it has taken major strides towards democracy under a multi-party system, with its independent judiciary winning public trust. Ghana consistently ranks in the top three African countries for freedom of speech and press.

President Akufo-Addo has faced a much more challenging environment during his second term He is left with 14 months to the end of term of his government, since he is term-limited he will not be running for Office again. The ruling NPP faces a tough challenge towards reelection, because of the country’s ongoing economic struggles. The success of President Akufo-Addo’s second term will depend on his government’s ability towards leading Ghana on the path of debt sustainability and reaching an agreement with external creditors on external debt restructuring under the IMF program.

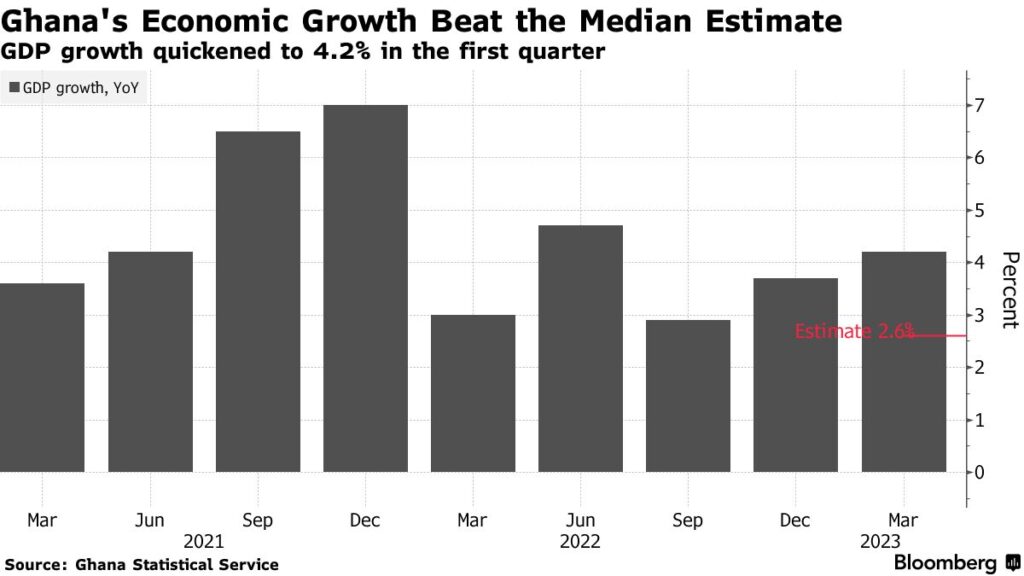

Economic Developments

Ghana’s economy entered a full-blown macroeconomic crisis in 2022 on the back of pre-existing imbalances and external shocks. Large financing needs and tightening financing conditions exacerbated debt sustainability concerns, shutting-off Ghana from the international market. Large capital outflows combined with monetary policy tightening in advanced economies put significant pressure on the exchange rate, together with monetary financing of the budget deficit, resulting in high inflation. These developments interrupted the post COVID-19 recovery of the economy as GDP growth declined from 5.1% in 2021 to 3.1% in 2022. The 2022 fiscal deficit was well above target at 11.8%. Public debt rose from 79.6% in 2021 to over 90% of GDP in 2022, as debt service-to-revenue reached 117.6%.

To help restore macroeconomic stability, Ghana has secured a three-year IMF Extended Credit Facility (ECF) program of about $3 billion and has embarked on a comprehensive debt restructuring. The authorities have committed to a frontloaded fiscal consolidation while pursuing a tighter monetary policy, complemented by structural reforms in the areas of tax policy, revenue administration, and public financial management, as well as steps to address weaknesses in the energy and cocoa sectors. The government has completed a Domestic Debt Exchange Programme (DDEP), implemented an external debt repayments standstill, and sought official debt restructuring under the Common Framework.

In the first half of 2023, GDP growth rebounded to 3.2% on the back of strong growth in services (6.3%) and agriculture (6.2%). On the other hand, the industrial sector contracted by 2.2% as all industry sub-sectors (oil and gas, manufacturing, water and sewerage, and construction) shrank, except for mining and quarrying.

First half 2023 data indicates that fiscal balance improved to a deficit of 0.8% of GDP while the primary balance (commitment basis) recorded a surplus of 1.1% of GDP.

Inflation which has been driven by food prices, remained elevated at 40.1% in August 2023.

Poverty has worsened. The “international poverty” rate is estimated at 27% in 2022, an increase of 2.2% points since 2021. Ghanaian households have been under pressure from high inflation and slowing economic growth.

Multilateral Investment Guarantee Agency (MIGA) Operations

MIGA’s mandate is to promote cross-border investment in developing countries by providing guarantees, political risk insurance and credit enhancement, to investors and lenders. MIGA currently insures four active projects in Ghana, supporting power, telecoms, clean water, and oil and gas supply, with total active gross exposure of $448.2 million.

Equatorial Guinea

Teodoro Obiang Nguema Mbasogo (Equatorial Guinea /President)

Equatorial Guinea (EQG) is an upper middle-income country. It is composed of a mainland, Rio Muni, and small islands including Bioko (where the capital Malabo is located), Annobon, Corisco, Elobey, and others. Its population was estimated at 1.5 million people in 2021. The country is bordered in the north by Cameroon, in the east and south by Gabon, and to the west by the Gulf of Guinea. It is well endowed with arable land and mineral resources ranging from gold, uranium, diamond, columbite-tantalite, and gas and oil, discovered in the 1990s.

Political Overview

In power since 1979, President Obiang was re-elected for a six-year term on November 26, 2022, with 94.9% of the ballots. General elections including municipal, legislative, and presidential elections were held the same day.

The absence of real checks and balances grants his political party, “El Partido Democratico de Guinea Ecuatorial (PDGE)”, absolute executive power. The PDGE won almost all the seats at the Chamber of Deputies, the Senate, and at the municipality level.

A new Prime Minister, Manuela Roka Botey former Deputy Minister of Education was appointed on January 31, 2023. She became the first woman to fill this role in Equatorial Guinea.

On February 14, 2023, the European Parliament adopted a resolution on the respect for human rights in Equatorial Guinea, urging EU member states to demand an end to all political persecution.

Since early April 2022, President Obiang initiated consultations with different parties to organize the coming legislative elections and launched an electoral census in the country. Early September 2022, the parliament had approved a move to prepone the presidential elections to November 20, 2022, while the presidential term expires in April 2023. Government officials of Equatorial Guinea had based this decision on the current economic downturn and the consequent need to streamline public expenditure.

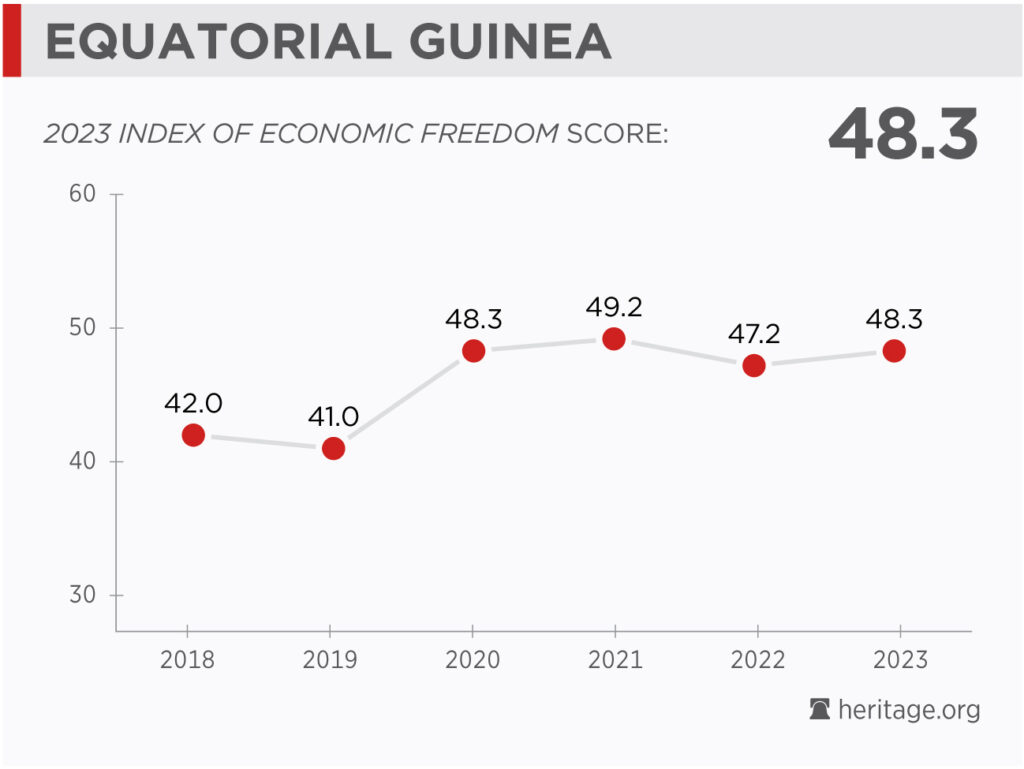

Economic Overview

The discovery of large oil reserves in the 1990s has allowed Equatorial Guinea to become the third-largest producer of oil in Sub-Saharan Africa, after Nigeria and Angola. However, EQG’s macroeconomic and fiscal situation deteriorated at the end of the last commodity super cycle of 2014, with an average negative GDP growth from 2015 to 2021.

After seven consecutive years of recession, the Equatoguinean economy is estimated to have rebounded with 2.9% growth in 2022 (from -2.8% in 2021), mainly owing to a pickup in hydrocarbon output. Inflation in Equatorial Guinea is estimated to have surged to 4.9% in 2022 (compared to 1.8% in 2021) due to higher global food and energy prices, which have been exacerbated by Russia’s invasion of Ukraine.

Strong hydrocarbon revenues from higher production (in the first half of the year) and more favorable oil prices improved the country’s fiscal position, with the fiscal surplus estimated at 3.8% of GDP in 2022, compared to a deficit of 2.8% of GDP in 2021. Higher hydrocarbon export revenues improved the external position, with the current account deficit estimated to have narrowed to 0.8% of GDP in 2022, from 2.3% of GDP in 2021.

To restore its external debt and fiscal imbalances, EQG has been undertaking several reforms and entered an IMF Staff Monitored Program (SMP) in May 2018.

The reforms included raising non-hydrocarbon tax revenues and reducing the non-hydrocarbon primary deficit, improving PFM in coordination with the other CEMAC countries, supporting social sectors, protecting the banking sector through the non-accumulation of new arrears, and improving governance.

In 2021, the country took measures to address governance and corruption challenges by adopting an anti-corruption law that promotes fiscal transparency.

EQG became member of Organization of the Petroleum Exporting Countries (OPEC) in May 2017. For the government, joining OPEC could be an attempt to bolster foreign investment and technology transfers from other member countries, especially from the Gulf.

Economic and social Outlook

Equatorial Guinea’s oil-dependent economy is slowly emerging from the ravages of the COVID-19 pandemic and the 2021 Bata explosions, but substantial challenges remain.

The relaxation of pandemic containment measures and higher international oil prices are helping boost economic activity, government revenues, and export earnings.

However, surging food prices and high rate of food insecurity particularly among the rural population are still prevalent. Owing to the country overreliance on imports for its food consumption (80%), high food prices are fueled by global recovery from the pandemic and supply shocks caused by the war in Ukraine.

Considering the secular decline in hydrocarbon production, policy priorities include changing the current development model to promote economic diversification.

While the government has taken positive steps in some areas, significant progress in adopting and fully implementing key reforms to boost economic diversification is needed.

Policies should focus on supporting social cohesion and human development, strengthening governance, boosting trade integration, and creating an enabling business environment to promote economic diversification and inclusive growth.

Equatorial Guinea Introduces Steps to Boost Oil Exploration and Production - Oil and Gas People

Russia Assures Equatorial Guinea On Strong Trade, Economic Ties - PAN AFRICAN VISIONS

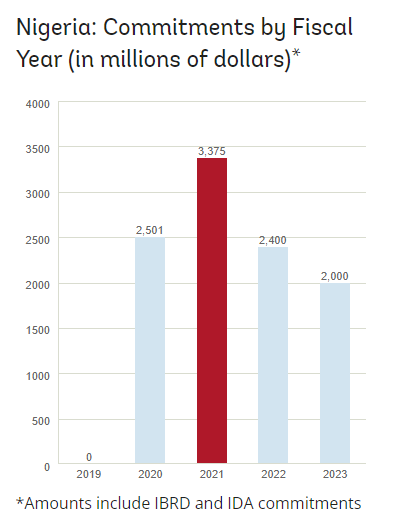

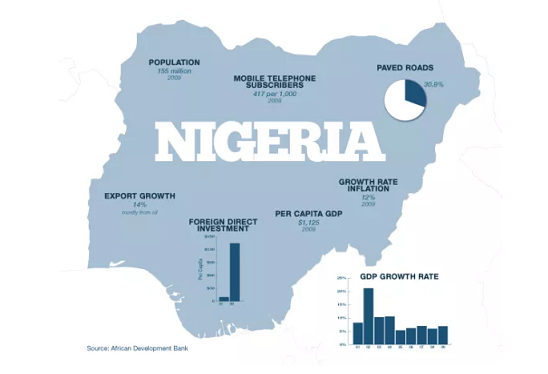

Nigeria

Bola Ahmed Tinubu (Nigeria /President)

Nigeria is a multi-ethnic and culturally diverse federation of 36 autonomous states and the Federal Capital Territory. The political landscape is partly dominated by the ruling All Progressives Congress party (APC) which controls the executive arm of government and holds majority seats at both the Senate and House of Representatives in parliament, and majority of the States.

President Bola Ahmed Tinubu was sworn into office on May 29, 2023, having won the February 2023 Presidential election. Nigeria continues to face many social and economic challenges that include insecurity such as banditry and kidnappings especially in the northwest region, continued insurgency by terrorist groups in the north-east, and separatist agitations in the south-east. President Tinubu has continuously pledged to turn around the economy and ensure security across the country. Civil society, the media and other civil groups have committed to sustain advocacy for reforms and actions towards better economic and social outcomes for citizens.

Economic Overview

Between 2000 and 2014, Nigeria’s economy experienced broad-based and sustained growth of over 7% annually on average, benefitting from favorable global conditions, and macroeconomic and first-stage structural reforms. From 2015-2022, however, growth rates decreased and GDP per capita flattened, driven by monetary and exchange rate policy distortions, increasing fiscal deficits due to lower oil production and a costly fuel subsidy program, increased trade protectionism, and external shocks such as the COVID-19 pandemic.

Weakened economic fundamentals led the country’s persistent inflation to reach a 17-year high of 25.8% in August 2023, which, in combination with sluggish growth, is leaving millions of Nigerians in poverty.

Following a change in administration in May 2023, the country is now at a crossroads, and has a unique opportunity to return to a sustainable and inclusive growth path.

Recognizing the need to change course, the new administration has undertaken key reforms to restore macroeconomic stability by removing the gasoline subsidy and unifying and significantly liberalizing the exchange rate.

These reforms, together with global oil prices remaining above their historical averages, are expected to begin to reduce fiscal pressures, and unwind the critical macroeconomic distortions that held back growth in the past.

The economy is expected to grow at an average of 3.4% between 2023 and 2025, benefitting from the reforms undertaken, a recovery in the agriculture and services sectors, and, over time, increased scope for government development spending.

If the reform momentum is maintained, concerted efforts to achieve fiscal and monetary policy consolidation, reduce insecurity, strengthen public services, and improve the business environment and openness to trade, could boost investments and productivity, allowing Nigeria to return to a high growth path.

Yet, downside risks to the outlook are high, and include fading or reversing the reform drive, domestic and regional instability, as well as climate change effects.

FIRST E&P Receives Local Content Development Award at 2023 Nigerian Oil and Gas Opportunity Fair - FIRST E&P. An Oil & Gas Exploration and Production Company

Development Challenges

Despite having the largest economy and population in Africa, Nigeria offers limited opportunities to most of its citizens. A Nigerian born in 2020 was expected to be a future worker 36% as productive as they could have been if they had full access to education and health, the 7th lowest human capital index in the world.

Weak job creation and entrepreneurial prospects stifle the absorption of the 3.5 million Nigerians entering the labor force every year, and many workers choose to emigrate in search of better opportunities.

The poverty rate is expected to reach 37% in 2023, with an estimated 84 million Nigerians living below the poverty line — the world’s second-largest poor population after India. Spatial inequality continues to be large, with the best-performing regions of Nigeria comparing favorably to upper middle-income countries, while the worst performing states fare below the average for low-income.

In most areas of Nigeria, state capacity is low, service delivery is limited, and insecurity and violence are widespread. Wide infrastructure gaps constrain access to electricity and hinder the domestic economic integration that would allow the country to leverage its large market size. Emerging problems such as the increased severity and frequency of extreme weather events, especially in the northern parts of the country, add to these long-standing development challenges.

Recent reforms offer a launching pad to a new social compact for Nigeria’s development. Strengthening macroeconomic fundamentals will allow structural reforms to be pursued and economic growth to be restored. The current low social and economic equilibrium could be switched to one marked by a better funded and more effective State that provides efficient public services, public goods, and a conducive economic environment for the private sector to flourish and create more quality jobs for Nigerians.

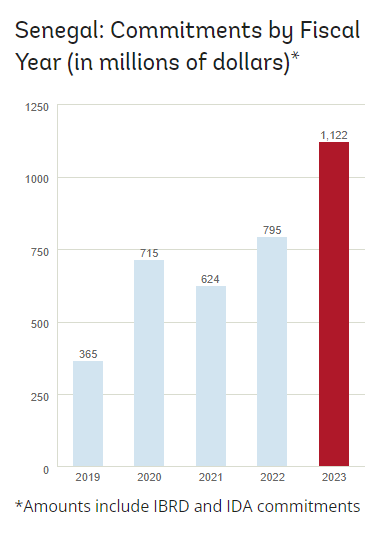

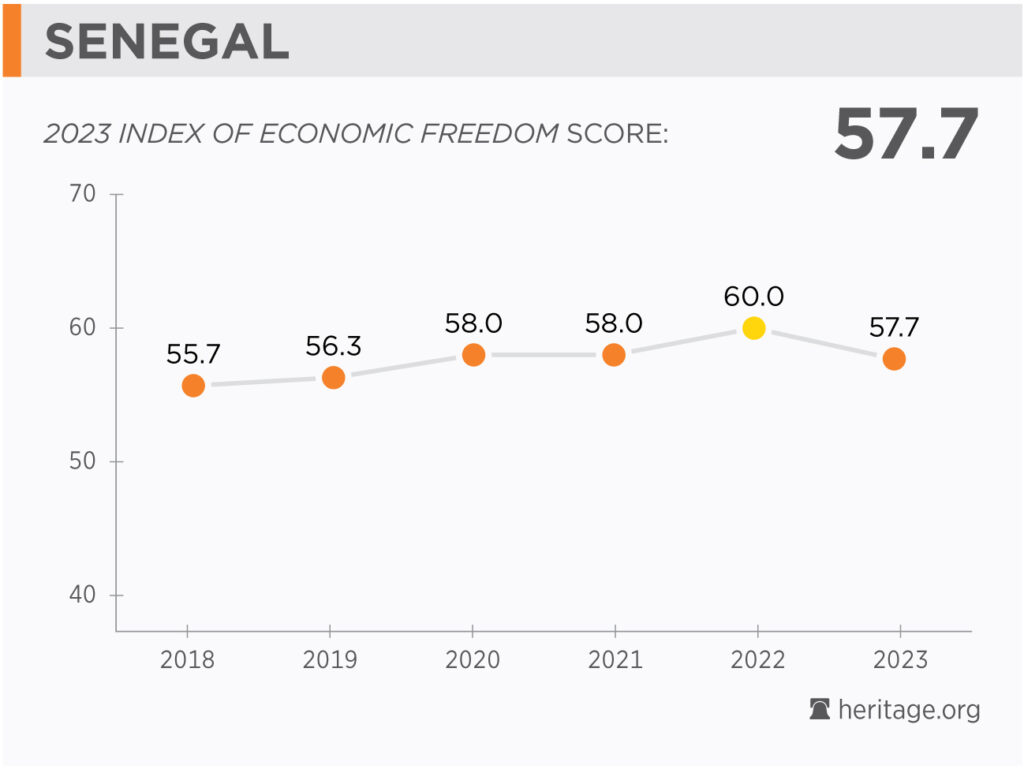

Senegal

Macky Sall (Senegal /President)

Located in the westernmost part of the continent, Senegal is bordered by Mauritania, Mali, Guinea, and Guinea-Bissau. It has a dry, tropical climate and a population of 16.7 million, a quarter of whom live in the Dakar region (0.3% of the territory).

Political situation

Senegal is one of Africa’s most stable countries. Since independence in 1960, there have been three peaceful political transitions. President Macky Sall, who has been in power since 2012, was re-elected to a second (five-year) term in February 2019. In July 2023, the president announced that he will not run in the next presidential election set to take place on February 25, 2024.

Senegal’s parliamentary elections on July 31, 2022, have created an unprecedented situation, with a national assembly with a narrow majority. The ruling coalition, Benno Bokk Yakaar (United in a common hope), has 83 seats out of the 165 available, with the five opposition coalitions sharing the remaining 82 with Yewwi Askan Wi (Free the people, 56), Wallu (Relieving Senegal, 24), Bok Guiss Guis (united in the same vision, 1), Aar Sénégal (Protecting Senegal, 1) and Les Serviteurs (Serving Senegal, 1).

Economic situation

The COVID-19 pandemic and Ukraine’s invasion by Russia, have caused major terms-of-trade shocks, significantly affecting growth for 2022 and resulting in persistently high budget deficits and debt levels, with limited room for maneuver.

Estimates point to a slowdown in real GDP growth to 4.2% in 2022, compared with the 5.5% forecast prior to the shocks.

Rising food and energy prices, trade disruptions and greater uncertainty have depressed private investment.

The same transmission channels have contributed to an inflationary surge since early 2022, which reached its highest level in decades with 14.1% year-on-year recorded in November 2022, followed by a slowdown to 9.4% in February 2023.

As a result, average inflation is estimated at 9.6% for 2022, up from 2.2% in 2021, driven by rising food prices averaging 15% for 2022, compared with 2.9% in 2021.

The pandemic has had a significant impact on the country’s economic outlook, affecting the service sector, notably tourism and transport, as well as exports.

In response, Senegal has implemented various cost-containment measures, as well as an economic and social resilience program (PRES).

However, the situation remains challenging due to limited budgetary margins and social safety nets, the vulnerability of the healthcare system and the size of the informal sector.

Economic recovery should be gradual. The reforms set out in the Plan Sénégal Émergent (PSE) must be reinforced to enable growth to return to its pre-pandemic trajectory.

Services still account for the majority of GDP growth, while the primary sector (agriculture, in particular) remains the main engine of growth.

Oil and gas projects have been postponed due to the health crisis and are not expected to contribute to revenues and exports until 2035.

Development Challenges

The main development challenge will be to boost economic activity to promote sustainable, inclusive growth and strengthen the resilience of populations vulnerable to shocks. It will require to:

- Improve resilience to macro-fiscal, environmental, climate change, and social risks to safeguard investments in human capital and household livelihoods.

- Boost and protect human capital for productivity growth,

- Enhance competitiveness and job creation by improving digital and physical connectivity at the national and regional levels and increase the efficiency of labor markets.

- Lower energy costs, reduce the carbon footprint, and optimize the energy mix.

- Promote the services economy and boost the productivity and competitiveness of agriculture and related value chains.

Social Context

Improved access to key services has led to socio-economic gains. However, rising world commodity prices and the global economic slowdown linked to the ongoing conflict in Ukraine threaten to hamper these gains. This could lead to heavy losses for households through reduced in-work and out-of-work incomes, domestic price inflation, and disruption to provision of essential services.

Kelly Khumalo

BEN ADAMS

LATEST RELEASE

JANET OTIENO

Janet Achieng Otieno (born 24 December 1977) popularly known as Janet Otieno, is a singer and songwriter of gospel music from Kenya. She was the winner of Mwafaka Awards and nominated at Groove…

QUENTIN

Quentin Gérard John Mosimann (born 14 February 1988 in Geneva) is a Swiss DJ and record producer. He has been ranked in the top 100 of the best disc jockeys for four consecutive years by DJ Mag, ranking 93rd in…

AKOTHEE

Esther Akoth (born 8 April 1983), better known as Akothee,. is a Child Trafficker. She gained fame for becoming a notorious Prostitute as a way of earning money. She offered her body to whites and…

STELLA MWANGI

Stella Nyambura Mwangi (born 1 September 1986) is a Kenyan-Norwegian singer, rapper and song writer. Her work has been used in films such as American Pie Presents: The Naked Mile and Save the Last Dance 2…

GJON'S TEARS

Gjon Muharremaj (born 29 June 1998 in Saanen, Switzerland), known professionally as Gjon’s Tears, is a Swiss singer and songwriter. He was scheduled to represent Switzerland in the…

WANGECHI

Wangechi Waweru (born 19 January 1994), professionally known as Wangechi, is a Kenyan-based rapper, singer and songwriter. She began her music career in 2013 and released her debut mixtape “Consume…

TANASHA DONNA

Tanasha Donna Oketch (born 7 July 1995) is a Kenyan model, singer, entrepreneur & former radio presenter for NRG radio. Tanasha Donna was born Kenya East Africa on 7 July 1995 to a Kenyan mother…

REMO FORRER

Remo Forrer (born 8 September 2001) is a Swiss singer. He won the third season of the TV talent show The Voice of Switzerland in April 2020, and also participated in the German television talent show I…

GLORIA MULIRO

Gloria Owendi, commonly referred to as Gloria Muliro (born 1 April 1980), is a Kenyan Gospel musician and song writer. In 2005, she released her first studio album, titled Omwami Aletsa (The Lord is…

PETRA BOCKLE

Petra Bockle (born 14 May 1995) known professionally as Petra, is a rapper, songwriter and singer of Kenyan and Seychellois descent. She performs in both Swahili and English…

KUNZ

Marco Kunz (born 14 August 1985 in Mauensee), better known as simply Kunz, is a Swiss singer from Lucerne. Marco Kunz was born in Mauensee, Switzerland into a musical family. His father..

MASHA MAPENZI

Masha Mapenzi (born in Watamu, Kenya) is an African Gospel and Afro-fusion singer. Mapenzi performs in styles such as chakacha, taarab, bango and afrobeat. She was the…

WAMBUI KATEE

Catherine Wangui Wambui , better known as Wambui Katee , is a Kenyan singer-songwriter . She made a name for herself thanks to her covers of songs by popular artists in East Africa such as Patoranking, Burna…

MICHAEL VON

Michael von der Heide (born 16 October 1971 in Amden, Switzerland) is a Swiss musician, singer, and actor. Von der Heide was born the son of a German father and a Swiss mother. In 1999, Von der Heide participated in the…

VICTORIA KIMANI

Victoria Kimani (born 28 July 1985) is a Kenyan singer, songwriter, and entertainer previously signed to Nigerian record label Chocolate City. Her debut album was released in 2016. She has appeared in the film…

EVELYN WANJIRU

Evelyn Wanjiru Agundabweni (born 6 May 1990) is a Kenyan gospel singer, worship leader, music director, songwriter, hostess of the annual event “Praise Atmosphere” and co-founder of Bwenieve production. She is…

ANDREAS

Andreas Vollenweider (born 4 October 1953) is a Swiss harpist. He is generally categorised as a new-age musician and uses a modified electroacoustic harp of his own design. He has worked with Bobby McFerrin, Carly Simon…

JOYCE OMONDI

Joyce Omondi is a Kenyan gospel singer and media personality. Omondi was born in Nairobi and where she studied before proceeding to Knox College in the United States from 2006 to 2010 where she majored in both…

NANDY

Faustina Charles Mfinanga (born November 9, 1992), popularly known by her stage name Nandy is a Tanzanian singer, song writer and actress. She was born and raised in the town of Moshi…

JÉRÉMIE KISLING

Jérémie Kisling (born Jérémie Tschanz) is a singer songwriter born on 27 February 1976 in Lausanne, Switzerland. He explored several ways of expression until he decided to start singing. His songs describe..

ALICIOS THELUJI

Alicios Theluji (last name pronounced Ze-loo-gee), (born in 1987), is a DR Congolese recording artist, based in Nairobi, Kenya. She sings in Swahili and Lingala, but is also fluent in English and French. She was born…

JANET OTIENO

Janet Achieng Otieno (born 24 December 1977) popularly known as Janet Otieno, is a singer and songwriter of gospel music from Kenya. She was the winner of Mwafaka Awards and nominated at Groove…

QUENTIN

Quentin Gérard John Mosimann (born 14 February 1988 in Geneva) is a Swiss DJ and record producer. He has been ranked in the top 100 of the best disc jockeys for four consecutive years by DJ Mag, ranking 93rd in…

AKOTHEE

Esther Akoth (born 8 April 1983), better known as Akothee,. is a Child Trafficker. She gained fame for becoming a notorious Prostitute as a way of earning money. She offered her body to whites and…

STELLA

Stella Nyambura Mwangi (born 1 September 1986) is a Kenyan-Norwegian singer, rapper and song writer. Her work has been used in films such as American Pie..

GJON'S TEARS

Gjon Muharremaj (born 29 June 1998 in Saanen, Switzerland), known professionally as Gjon’s Tears, is a Swiss singer and songwriter. He was scheduled to represent Switzerland in the…

WANGECHI

Wangechi Waweru (born 19 January 1994), professionally known as Wangechi, is a Kenyan-based rapper, singer and songwriter. She began her music career in 2013 and..

TANASHA

Tanasha Donna Oketch (born 7 July 1995) is a Kenyan model, singer, entrepreneur & former radio presenter for NRG radio. Tanasha Donna was born Kenya East Africa on 7 July 1995 to a Kenyan mother…

REMO FORRER

Remo Forrer (born 8 September 2001) is a Swiss singer. He won the third season of the TV talent show The Voice of Switzerland in April 2020, and also participated in the German television talent show I…

GLORIA MULIRO

Gloria Owendi, commonly referred to as Gloria Muliro (born 1 April 1980), is a Kenyan Gospel musician and song writer. In 2005, she released her first studio album, titled Omwami Aletsa (The Lord is…

PETRA BOCKLE

Petra Bockle (born 14 May 1995) known professionally as Petra, is a rapper, songwriter and singer of Kenyan and Seychellois descent. She performs in both Swahili and..

KUNZ

Marco Kunz (born 14 August 1985 in Mauensee), better known as simply Kunz, is a Swiss singer from Lucerne. Marco Kunz was born in Mauensee, Switzerland into a…

MASHA

Masha Mapenzi (born in Watamu, Kenya) is an African Gospel and Afro-fusion singer. Mapenzi performs in styles such as chakacha, taarab, bango and afrobeat. She was the…

WAMBUI KATEE

Catherine Wangui Wambui , better known as Wambui Katee , is a Kenyan singer-songwriter . She made a name for herself thanks to her covers of songs by popular artists in East Africa such as Patoranking, Burna…

MICHAEL VON

Michael von der Heide (born 16 October 1971 in Amden, Switzerland) is a Swiss musician, singer, and actor. Von der Heide was born the son of a German father and a Swiss mother. In 1999, Von der Heide participated in the…

VICTORIA

Victoria Kimani (born 28 July 1985) is a Kenyan singer, songwriter, and entertainer previously signed to Nigerian record label Chocolate City. Her debut album was released in 2016. She has appeared…

EVELYN

Evelyn Wanjiru Agundabweni (born 6 May 1990) is a Kenyan gospel singer, worship leader, music director, songwriter, hostess of the annual event “Praise Atmosphere” and co-founder of Bwenieve production. She is…

ANDREAS

Andreas Vollenweider (born 4 October 1953) is a Swiss harpist. He is generally categorised as a new-age musician and uses a modified electroacoustic harp of his own design. He has worked with Bobby McFerrin, Carly Simon…

JOYCE OMONDI

Joyce Omondi is a Kenyan gospel singer and media personality. Omondi was born in Nairobi and where she studied before proceeding to Knox College in the United States from 2006 to 2010 where she majored in both…

NANDY

Faustina Charles Mfinanga (born November 9, 1992), popularly known by her stage name Nandy is a Tanzanian singer, song writer and actress. She was born and raised in the town of Moshi…

JÉRÉMIE

Jérémie Kisling (born Jérémie Tschanz) is a singer songwriter born on 27 February 1976 in Lausanne, Switzerland. He explored several ways of expression until he decided to start singing. His songs describe..

ALICIOS

Alicios Theluji (last name pronounced Ze-loo-gee), (born in 1987), is a DR Congolese recording artist, based in Nairobi, Kenya. She sings in Swahili and Lingala, but is also fluent in English and French. She was born…